Discover expert tips on selecting the perfect fabric for your bespoke women’s suit. Elevate your style with tailored sophistication today!

Trending Posts

Great Small Gift Ideas for Coworkers

In today’s fast-paced work environment, fostering positive relationships with colleagues is crucial for a thriving team spirit. Showing appreciation for your coworkers goes a long way in boosting […]

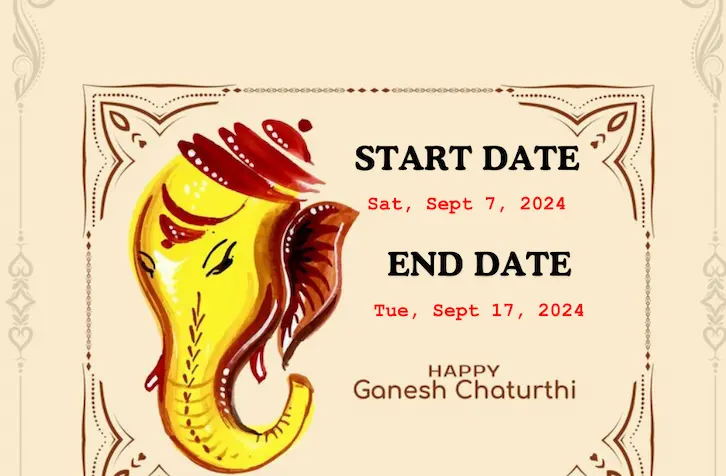

Ganesh Chaturthi 2024 Start and End Date USA

Get ready to celebrate Ganesh Chaturthi in the USA! This sacred Hindu festival, honoring Lord Ganesha, brings people together in joyous festivities and divine blessings. In 2024, Ganesh […]

A Guide to Buying Puja Samagri in the USA

Are you a devotee residing in the USA, looking to uphold your religious traditions and perform pujas with authenticity? Look no further! In this article, we will guide […]

A Guide to Creating a Personalized Pooja Box

Welcome to the spiritual realm, where personalization meets devotion in the form of a personalized pooja box. In this fast-paced world, finding time for spiritual rituals can be […]

Favorite Things Party Gift Ideas

Get ready to be the hostess with the mostess at your next favorite things party! With our ultimate guide to gift ideas, you’ll be able to unwrap the […]

DIY Soccer Coach Gift Ideas

Show your appreciation for your soccer coach with these creative DIY gift ideas! Whether it’s for a special occasion or just to say thank you, finding the perfect […]

Super Word Skills: How to Get Better at Words!

Words are the building blocks of communication, shaping our thoughts, emotions, and interactions with the world. Whether spoken or written, words have the power to inspire, educate, persuade, […]

Crucial Factors in Loan Against Property Interest Rates

In the dynamic realm of financial instruments, the Loan Against Property (LAP) has surfaced as a multifaceted solution, empowering individuals to harness the intrinsic value of their properties […]

Unique Birthday Gifts For Tech Lovers

Are you tired of giving the same old boring birthday gifts? Want to surprise your tech enthusiast friend with something truly unique? Look no further! In this article, […]