As aspiring young investors, the primary target is to make the most out of every investment strategy they choose. As easy as it may sound, this requires critical analysis, in-depth market research and utilising all the applicable digital tools available at hand to avoid human errors.

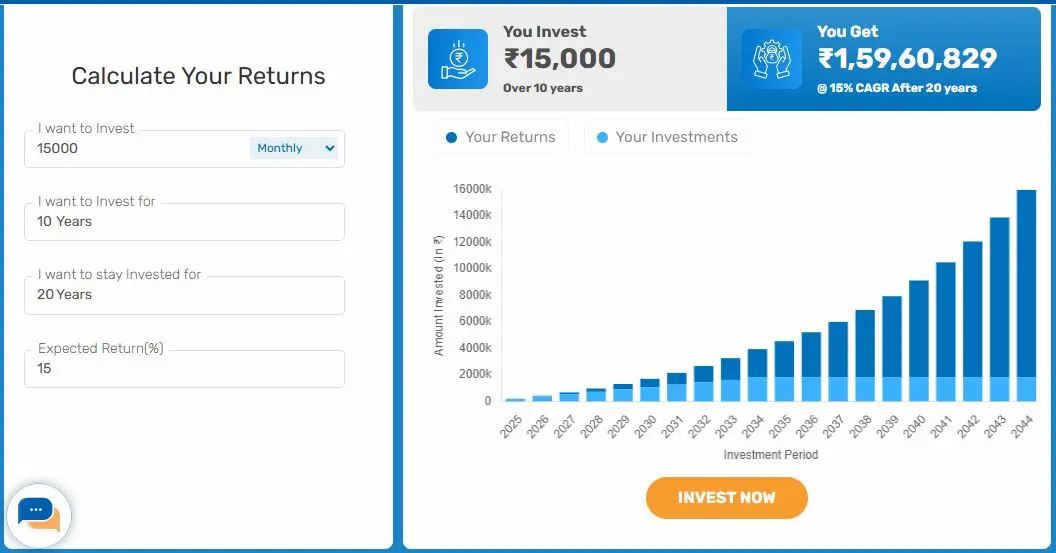

Understanding and leveraging the full potential of compound interest calculators can help you effectively cover extensive ground in this regard. A compounding calculator efficiently reveals the potential outcome of your investment. You can compare various investment options and make the necessary additions and alterations as required to fulfil your financial targets.

Power of compounding

The power of compounding refers to interest generation from previous earnings. The returns of your initial invested amount also get invested and earn you interest on interest, thereby allowing exponential growth. The initial principal and the accrued interest both earn interest here, unlike simple interest, where only the interest gets calculated on the initial principal amount.

A compounding calculator makes you understand the potential profit margins from your planned investment strategy for a stipulated period at a given interest rate.

Methods for effectively using compounding calculators

Using a compounding calculator is easy. This digital tool maintains a user-friendly interface that proves to be highly useful and easily accessible online. However, to ensure utilisation of the full potential of your investments, you need to first understand the working strategy of the compounding calculator to make informed usage and decisions:

- Understand the formula

The compound interest formula is A = P (1+r/n)^(nt), where A is the final amount (principal + interest), P is the initial principal amount, r is the annual rate of interest, n is the compounding frequency/year, and t is the tenure of investment.

- Leveraging the features of the calculator:

- Analysing the scenario: Utilise this calculator for exploring multiple interest rates, investment tenures, and several compounding frequencies to understand their impacts on your planned investments.

- Savings: Try to simulate the effects of regular contributions for a stipulated period to evaluate their effects on compounding, besides your initial investment funds.

- Financial planning: Be specific about your future financial targets so that you can plan accordingly by setting the tenure and amount aligning with your necessities.

- Compare: You have to use the calculator for compare the potential returns from various investment options like bonds, stocks, ULIPs, mutual funds, etc. considering their compounding frequencies and interest rates.

- Rule of 72: This means that (72/rate of interest = approximate tenure for doubling the investment). Use this formula to perform a quick assessment of the potential growth of an investment.

- Strategies:

- Begin early: To enjoy an optimum outcome, exercise your strategies as early as possible, right from the beginning of your career settlement. The longer your investment horizon happens to be, the better the power of compounding will work.

- Regular investment: You have to inculcate the habit of regular savings and investment right from the beginning without fail. Be it a small amount, but maintain a consistent approach.

- Long-term growth: Always try to focus on the long-term potential of the power of compounding rather than short-term fluctuations of the market. This allows better corpus-building opportunities.

- Diversification: Never keep all your eggs in one basket. Maintain a diversified portfolio to reduce the risks associated.

- Tax benefits: Consider exploring options that allow tax benefits like ULIPs, life insurance, term insurance, etc.

- Online compounding calculators:

- Free digital tool: You can easily access a digital compounding calculator from the official websites of various financial organisations.

- Simplify: Utilising these calculators helps you to simplify complicated calculations, avoiding human errors and offering valuable insights into the compounding potential.

Advantages of a compound interest calculator

The rate of power of compounding can be easily understood with the help of a compound interest calculator. Some of its best advantages include:

- User-friendly:

The future of any compound interest investments can best be understood with the aid of a compounding calculator. It is extremely user-friendly and maintains an easy interface, so that it seems easy for beginners too. You simply need to enter the basic details as required and submit to know the results.

- Time efficient:

These calculators easily reveal the power of compounding in no time. Manual calculations are far more time-consuming and are risk to errors. These are super precise, accurate and 100% reliable.

- Facilitates financial planning:

This comprehensive tool helps investors to plan strategically to fulfil their targets well with ease.

- Free:

Compound interest calculators are available for free on online platforms.

- Enables comparison:

You can compare various scenarios with this calculator and proceed accordingly based on the results.

Conclusion:

Understanding the power of compounding is the key step to begin a successful financial journey. The sooner you begin, the better.

Disclaimer: This blog provides general financial information for educational purposes only. It is not financial or investment advice. Please consult a professional before making any financial decisions. We are not responsible for any losses or actions taken based on this content.

Aditya Anand is an experienced blogger with over 6 years in content creation. He specializes in building detailed guides on wellness and general health tips. By focusing on practical, well-researched information, Aditya ensures his readers have the tools they need to live a healthier lifestyle.