In the dynamic realm of financial instruments, the Loan Against Property (LAP) has surfaced as a multifaceted solution, empowering individuals to harness the intrinsic value of their properties to meet diverse financial requirements. An imperative facet demanding the attention of borrowers as they embark on the LAP journey is the interest rate. This article meticulously explores the pivotal factors that shape Loan Against Property interest rates, providing insights into critical aspects like Loan Against Property Balance Transfer, Tax benefits, EMI calculation, and Eligibility Criteria.

Understanding Loan Against Property Interest Rates

The interest rate serves as the expense associated with borrowing and holds substantial influence over the overall affordability of a Loan Against Property. In order to make well-informed decisions, borrowers should take into account the following factors:

Market Trends and Economic Conditions

Loan Against Property interest rates fluctuate based on market dynamics and economic conditions. In prosperous times, rates tend to rise, while in economic downturns, they tend to fall. By keeping a close eye on these trends, borrowers can strategically time their loan applications to align with favorable interest rates, optimizing their financial outcomes.

Loan Against Property Balance Transfer

When aiming to enhance their financial commitments, borrowers must give careful thought to Loan Against Property Balance Transfer. The strategic move of transferring one’s LAP to another lender, offering a lower property loan interest rate, holds the potential for significant savings throughout the loan tenor. However, a judicious decision requires a thorough evaluation of the associated costs and benefits, ensuring that the advantages of the transfer outweigh any potential drawbacks.

Tax Benefits on Loan Against Property

A comprehensive grasp of the tax implications associated with Loan Against Property (LAP) is imperative for optimizing savings. Specifically, the interest paid on a Loan Against Property qualifies for tax benefits in specific circumstances. Staying abreast of the latest tax regulations is essential for borrowers, and seeking guidance from financial advisors ensures the effective leveraging of these advantages. This proactive approach not only contributes to financial efficiency but also aligns borrowers with optimal tax-saving strategies within the ambit of LAP.

Loan Against Property EMI Calculator

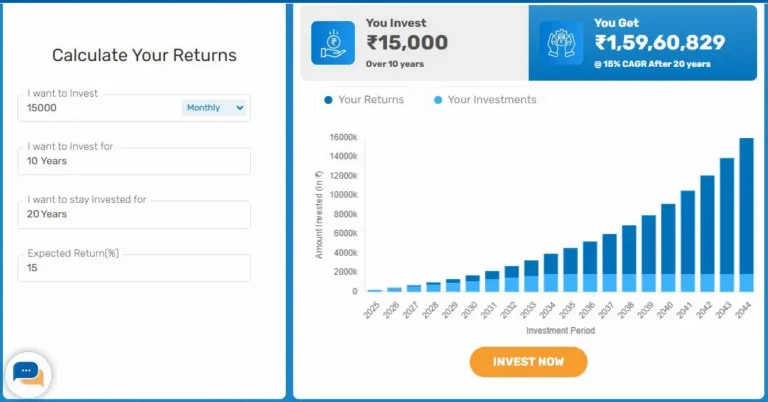

Using a Loan Against Property EMI calculator is a practical way to assess loan affordability. This tool considers essential factors like loan amount, interest rate, and tenor, providing borrowers with a clear understanding of their monthly repayment responsibilities. By utilizing this tool, borrowers can align their loan terms with their financial capacity, ensuring a sensible and sustainable approach to managing monthly financial commitments.

Here’s a step-by-step guide on how to use a LAP EMI calculator:

Step 1: Look for a trustworthy LAP EMI calculator on the internet. Many financial institutions and third-party financial websites offer these calculators.

Step 2: Specify the amount you wish to borrow as a Loan Against Property.

Step 3: Input the annual interest rate offered by the lender.

Step 4: Specify the repayment period in years or months.

Step 5: The calculator will instantly display your Equated Monthly Installment (EMI). This is the amount you need to pay each month towards repaying the loan.

By using a property loan EMI calculator, borrowers can make informed decisions, ensuring that the loan aligns with their financial capabilities and goals. It’s a valuable tool for planning and managing repayments throughout the loan tenor.

Loan Against Property Eligibility Criteria

Lenders set specific eligibility standards to assess borrowers’ creditworthiness. Factors such as income, credit score, property value, and the borrower’s age play a crucial role in determining eligibility. Meeting these criteria not only boosts the chances of loan approval but also influences the interest rate offered by the lender. By meeting these benchmarks, borrowers not only secure approval but also position themselves for favorable terms, emphasizing the connection between eligibility criteria and the interest rate dynamics set by lending institutions.

Conclusion

In conclusion, getting a Loan Against Property requires careful thought, especially regarding interest rates. Staying updated on market trends, considering balance transfers, knowing tax benefits, using EMI calculators, and meeting eligibility criteria empower borrowers. Prior to starting, thorough research, professional advice, and choosing a lender aligned with your financial goals are essential. Unlocking the true potential of a Loan Against Property hinges on informed decisions and using available tools effectively.

(Disclaimer: The information provided in this article is for general informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any decisions about loans.)

Derek is a content marketer with a combined experience of 5 years. He is well acquainted with the Education, Health, Travel, Education & BFSI Industry, currently exploring his interest in writing. In his free time, Derek enjoys reading and travelling.