Borrowers can switch from one lender to another offering lower interest rates by opting for a home loan balance transfer. When you opt for this facility, your current loan is acquired by a new lender who then pays off your outstanding loan. Your current lender will release the property documents and provide a no-due certificate to the borrower once they have received the outstanding payment. Once this is done, you’ll have to pay all of the remaining EMIs to the new lender based on their interest rate. To facilitate this, you will have to close your old home loan account and open a new one with your new lender, the one who is offering you better terms, such as a lower rate of Interest, convenient tenor, etc.

Now that we know what is home loan balance transfer, let us look at the benefits of this facility.

Top Advantages of a Home Loan Balance Transfer

The main benefit of a home loan balance transfer facility is that it helps you get a lower interest rate on your home loan. You can also get benefits like pre-approved offers, better terms for paying back the loan, a longer loan term, and better customer service.

Here are some of the best features and benefits associated with a home loan balance transfer

Pay Less Interest on Your Remaining Home Loan Balance

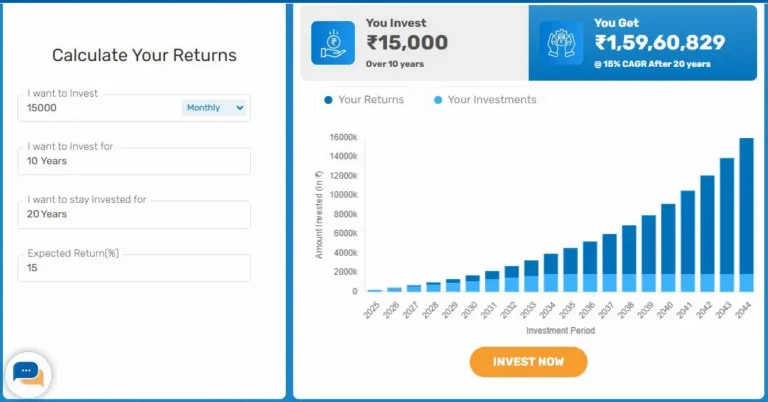

The main benefit of a home loan balance transfer facility is that it lets you lower the interest rate on your home loan. You can switch to a lender with a lower interest rate to pay off your house loan. This way, you’ll have to pay less interest on the amount you still owe on your home loan and your home loan EMIs will also go down. It’s also possible to go from a fixed rate of interest to a floating rate of interest by transferring the balance of your home loan. Calculate your EMI savings using a home loan balance transfer calculator before making the switch.

Easier Terms

When borrowers opt for a home loan balance transfer, they not only get the chance to negotiate for better interest rates but they also get the opportunity to negotiate for better repayment terms with your new lender. The rules for paying back a home loan vary from one lender to the next. For example, a new lender might be able to offer you a more favorable tenor for your home loan than your current lender. Similarly, your new lender may be more accommodating regarding EMI dates and repayment.

Pre-Approved Offers

From time to time, many lenders come up with pre-approved offers to onboard new customers. Under these offers, borrowers give bigger reductions on house loan interest rates and other borrower-friendly policies. You should keep a watch out for such offers from various lenders. Transfer your home loan balance if you get an offer that makes it easier for you to pay back your loan.

Top-up loan

A top-up loan is an easy way to get more money in case you run out of funds. This top-up loan may help you fulfill additional housing purchase requirements or any other requirement you may have. Some lenders offer the home loan top-up option and some don’t. So, before making the switch, make sure to ask your new lender if they will let you avail of a top-up loan.

Better Customer Service

If you find that your prospective new lender provides superior service to your current one, you may want to consider transferring the balance of your loan to them. There are a variety of home loan providers, but not all of them offer the same services, such as round-the-clock customer service, online payment of EMIs, and full account monitoring via a website or mobile app. If your current lender doesn’t offer these kinds of services, you can move the balance of your home loan to the new lender.

Things to Look out for Before You Switch Your Lender

Now that you know the advantages of moving your house loan balance to a new lender, let’s go over some items you should double-check.

Reliability

When a lender gives you a better interest rate, it’s easy to become enticed. Still, before shifting your home loan balance to a new lender, you should always investigate their reliability. Always go with a reputed and reliable lender.

Costs and Benefits

Your decision should be based on a thorough evaluation of the costs and benefits involved. Don’t opt for the transfer unless the positives outweigh the negatives.

Documents and Eligibility

Make sure you’re eligible to transfer your home loan balance with your new lender before submitting an application. Also, check the documents you will need to transfer the balance of your home loan. Keep these documents ready with you.

New Lender’s Terms and Conditions

Before you move the rest of your home loan to the new lender, you must make sure you understand all of the terms and conditions that come with it. Make sure you understand everything in the fine print before moving on.

Final Thoughts

Today, thanks to the convenience of online banking, transferring a home loan is a breeze. All of the borrower’s information, including their credit score, is available online. This makes it easier to go for home loan balance transfer. When you pay a higher interest rate, managing your monthly expenses while also paying your EMIs can cause significant financial hardship. Consider transferring the balance of your home loan to another lender to take advantage of reduced interest rates as well as other added features and benefits.

(Disclaimer: The information provided in this article is for general informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any decisions about loans.)

Aditya Anand is a passionate blogger with 4 years of experience. Being a passionate blogger also does blogging on the Finance, Travel, Health Tips, Life Style, Business, Technology, Fashion and Entertainment niche.